How a Home Loan Calculator Can Help You in Locating the very best Mortgage Prices

How a Home Loan Calculator Can Help You in Locating the very best Mortgage Prices

Blog Article

Innovative Financing Calculator: Empowering Your Budgeting Approaches

In the world of personal money, the relevance of efficient budgeting strategies can not be overemphasized. A cutting-edge lending calculator stands as a device that not only facilitates the comprehension of various car loan alternatives yet additionally aids in deciphering elaborate settlement routines. Its effect goes beyond simple numerical calculations; it plays an essential duty in checking one's monetary health and wellness and, inevitably, in optimizing budgeting methods. By taking advantage of the power of user-friendly features, this calculator paves the means for an extra informed and encouraged strategy towards handling financial resources. This device's possibility to revolutionize the way people browse their economic landscape is undeniable, using a look into a realm where budgeting comes to be greater than simply number crunching.

Recognizing Car Loan Choices

When thinking about borrowing money, it is important to have a clear understanding of the numerous loan options readily available to make educated financial decisions. One usual kind of lending is a fixed-rate loan, where the rate of interest stays the same throughout the car loan term, giving predictability in regular monthly payments. On the other hand, adjustable-rate lendings have rate of interest that vary based on market conditions, using the possibility for reduced initial rates however with the danger of raised settlements in the future.

Another alternative is a protected car loan, which needs security such as a home or automobile to safeguard the borrowed quantity. This kind of funding normally uses reduced rate of interest because of the reduced risk for the lending institution. Unprotected lendings, nevertheless, do not call for collateral however frequently featured greater rates of interest to make up for the raised risk to the loan provider.

Comprehending these financing choices is critical in picking one of the most ideal funding option based upon specific needs and economic scenarios. home loan calculator. By considering the advantages and disadvantages of each kind of car loan, debtors can make educated choices that line up with their lasting economic objectives

Computing Payment Schedules

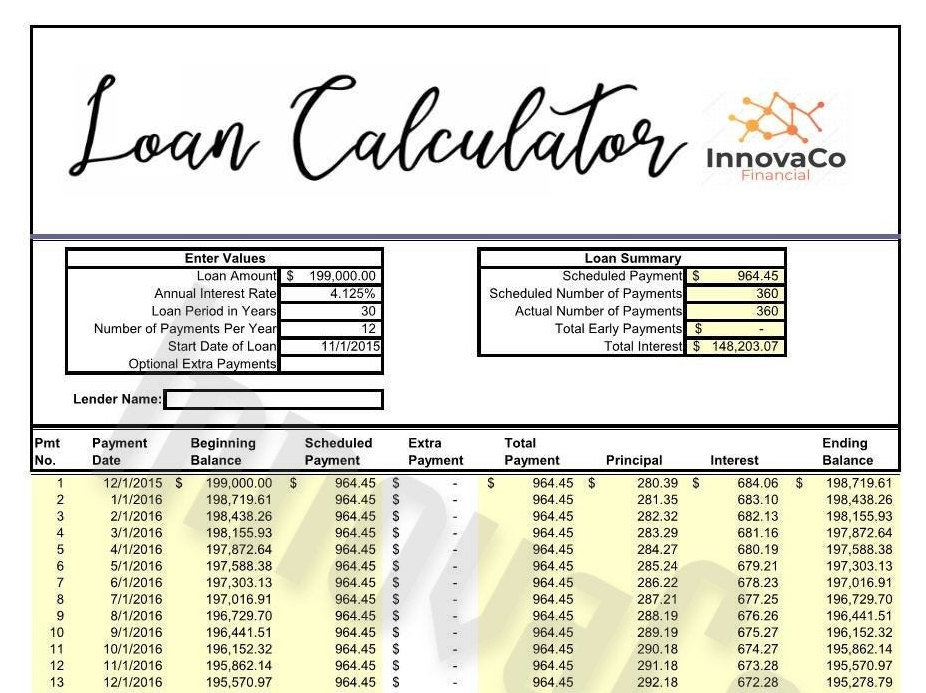

To properly take care of funding settlement commitments, understanding and properly determining repayment schedules is paramount for maintaining economic security. Computing settlement routines involves determining the quantity to be paid off occasionally, the frequency of payments, and the overall duration of the finance. By breaking down the total financing amount into manageable routine settlements, debtors can spending plan properly and make sure prompt payments, therefore staying clear of late costs or defaults.

There are various approaches to compute repayment schedules, consisting of using loan amortization schedules or on-line financing calculators. Financing amortization schedules supply a detailed breakdown of each payment, revealing just how much of it goes in the direction of the primary quantity and how much towards rate of interest. Online financing calculators simplify this procedure by enabling individuals to input lending details such as the major amount, rate of interest rate, and financing term, generating a settlement timetable instantly.

Determining and understanding settlement timetables not just aid in budgeting however also provide debtors with a clear review of their monetary commitments, allowing them to stay and make educated choices on track with their repayment commitments.

Tracking Financial Wellness

Monitoring monetary wellness includes consistently analyzing and examining one's economic standing to make certain security and notified decision-making. By maintaining a close eye on essential economic signs, individuals can determine possible issues beforehand and take proactive measures to address them. One critical aspect of checking monetary wellness is tracking earnings and costs (home loan calculator). This includes developing a budget, categorizing costs, and comparing actual investing to the allocated amounts. Discrepancies can signify overspending or economic mismanagement, motivating changes to be made.

Furthermore, keeping an eye on financial investments and cost savings is essential for long-term financial health. Regularly examining financial investment portfolios, pension, and emergency situation funds can assist people assess their progression towards meeting financial objectives and make any type of needed changes to optimize returns. Keeping track of financial obligation degrees and credit history scores is additionally important in assessing total financial health and wellness. Keeping an eye on financial obligation balances, rates of Discover More interest, and credit scores application can help people manage financial obligation efficiently and maintain a healthy credit profile.

Making The Most Of Budgeting Approaches

In optimizing budgeting approaches, people can leverage different methods to improve economic preparation and resource allotment effectively. One trick approach to optimize budgeting techniques is with establishing clear financial objectives. By developing particular objectives such as conserving a particular quantity monthly or lowering unneeded expenditures, people can straighten their budgeting efforts in the direction of accomplishing these targets. Additionally, monitoring expenditures faithfully is critical in recognizing patterns and locations where changes can be made to maximize the budget plan additionally. Utilizing technology, such as budgeting applications or monetary monitoring devices, can improve this process and supply real-time insights right into costs habits.

In addition, focusing on financial savings and investments in the spending plan can assist individuals secure that site their economic future. By assigning a portion of income in the direction of financial savings or pension prior to other costs, people can develop a safety and security web and work towards long-lasting monetary security. Looking for professional suggestions from economic coordinators or consultants can additionally aid in optimizing budgeting strategies by receiving tailored advice and expertise. Generally, by employing these strategies and remaining disciplined in budget management, people can effectively optimize their economic resources and attain their monetary objectives.

Using User-Friendly Features

Final Thought

In final thought, the ingenious funding calculator supplies a useful device for individuals to recognize finance alternatives, calculate repayment timetables, monitor financial wellness, and make the most of budgeting strategies. With straightforward attributes, this device empowers users to make educated monetary choices and prepare for their future economic goals. By making use of the finance calculator successfully, individuals can take control of their funds and achieve higher financial stability.

Keeping track of monetary wellness involves routinely evaluating and assessing one's monetary status to make sure stability and informed decision-making. In general, by utilizing these strategies and staying disciplined in budget monitoring, individuals can properly optimize their financial resources and attain their monetary objectives.

In final thought, the innovative financing calculator offers an important device for people to comprehend funding choices, compute settlement routines, monitor financial health, and optimize budgeting techniques. With straightforward features, this device empowers users to make informed economic choices and plan for their future monetary goals. By using the finance calculator efficiently, people can take control of their funds and attain higher economic security.

Report this page